Automotive Industry - Q1 2020 Market Update

Suzuki use their 'For Fun's Sake' brand identity to parody premium European luxury Autos

The Baleno model looks to harness market share for Suzuki in the Light <$25K segment with a tongue-in-cheek campaign emulating the look and feel of adverts from the European luxury segment.

The Das Talkomobile technology is a device that allows vehicles to talk to drivers and passengers - a value add that still keeps the model around the very affordable C. $20k price mark. Although this has the hallmark of a Retail campaign (the price point is integrated within the TVC) the brand personality is what categorises this ad - an example of 'Brandtail' advertising spanning TV and Digital placements for the $1m+ advertising investment.

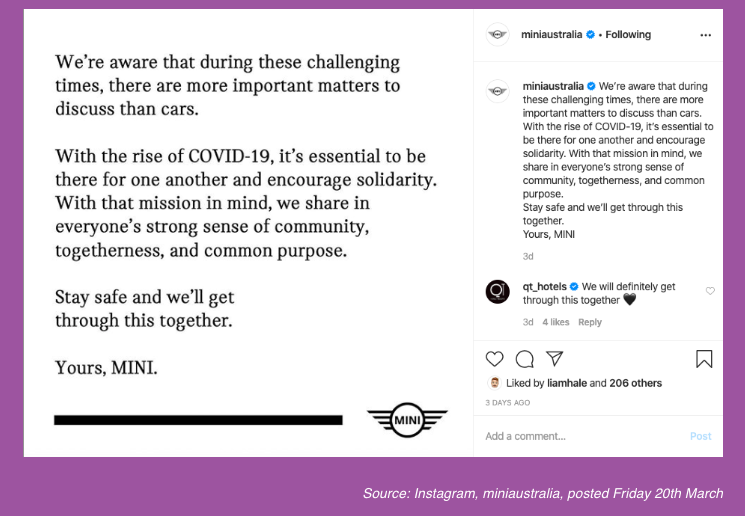

Source: Instagram, miniaustralia, posted Friday 20th March

MINI is trailblazer in corporate & social responsibility through recent comms on COVID-19 virus

Despite the current Automotive market facing hard-hitting sales challenges MINI has distinguished itself as a supportive and socially-forward-thinking brand in its latest social post. Although selling vehicles is a subject front of mind for all OEMs right now, MINI's recognition that people's health and safety is paramount is heartening.

Often thought of as the challenger brand within the BMW Group MINI inject a commendable personality into their latest post: harnessing the power of social media to humanise and disperse a message of solidarity to its 15.6k followers.

Our Insights of Note

-

Unsurprisingly marketing spends have taken a dip YOY across the sector: Dec 2018 - Feb 2019 saw an average industry spend of $50m+ whereas this year during the same period we are looking at an average of C. $38m

-

Spend into Corporate Branding has remained flat but high across the industry when comparing YOY, but the largest jump is seen in the SUV Small <$40k category which has increased by around 8% (from avg. 7% in 2018/2019 to almost 15% this year)

- The three models contributing to spend growth in this category are the Toyota C-HR, Kia Seltos and Mazda CX-30 - all with $1m+ spent on advertising this year so far

-

In this category Kia's 'It'll Move You' campaign caught our eye. Following their Australian Open sponsorship earlier this year they have injected around $2.4m on their new Seltos launch: A sleek, urban creative pulses in the TVC with brand recognition and frequency boosted by a heavy Digital presence

-

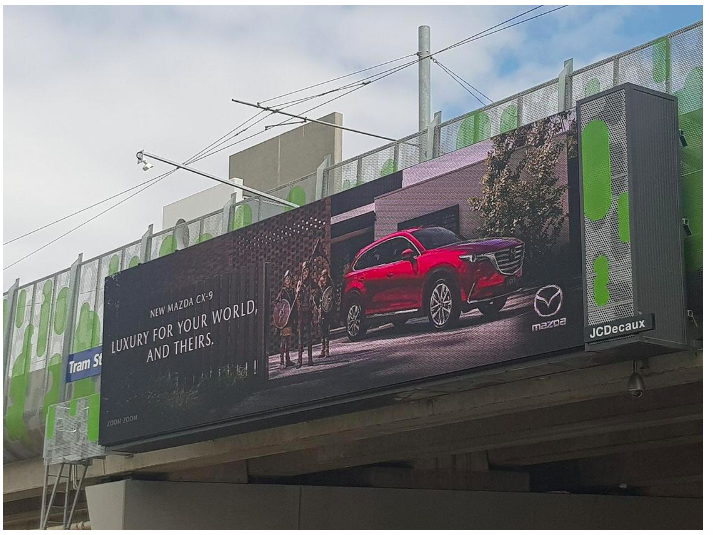

SUV Large <$70k is just as competitive with 15% of current Automotive media spend share, dominated by the Mazda CX-9 using an interesting blend of TV, Magazine, Out of Home and Radio placements - noticeably appealing to a broad market with a breadth of channel/publication targeting

Sources: BigDatr & SMI - 2019 and 2020 Media Spend

-

Interestingly, although TV does still takes the lion's share of media spend for both Brand and Retail advertising strategies across the sector, this media type has taken the biggest dollar hit YOY so far. TV still benefits from around 52% of traditional media spend across the Auto sector, but whereas Out of Home has grown in $ investment ($9.4m for Jan & Feb 2019 Vs $9.9m for Jan & Feb 2020), TV has come back from almost $33m to $24m. The impact of digital spending is clearly being heavily felt on TV, with brands potentially capitalising on the speed and flexibility of digital buys in a tough climate

-

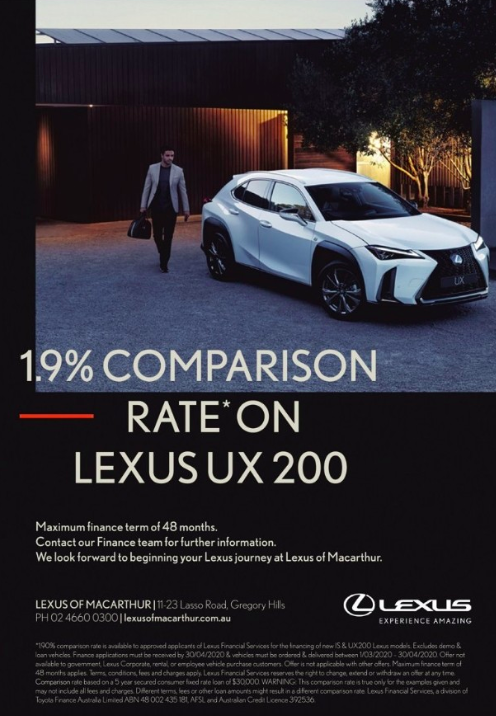

Although it is too early to say for many brands whether their 2020 strategy will swing towards Brand or Retail across the year, Lexus have bucked the trend and invested almost 5x the amount into Retail over Brand advertising. Although at the pricier end of their segments Lexus have proffered complimentary upgrades and slashed price points to compete

Source: BigDatr, Lexus, The All-New Lexus UX