A tale of two sports: how the AFL and NRL played with their marketing budgets last season

Footy fans across the country are getting the beers in and the snags ready—the 2023 season kicks off on 2nd March for the NRL and 16th March for the AFL.

If last year was anything to go by, supporters can expect plenty of triumphs, tribulations, and everything in between. Whether it’s off-pitch dramas, on-pitch clashes, a rise from the ashes, or a fall from grace, the footy season is never dull.

Using insights from the Bigdatr platform, we compare the two, check out what they did creatively and look at where they might have capitalised on or missed opportunities.

AFL: bigger revenue, bigger budgets

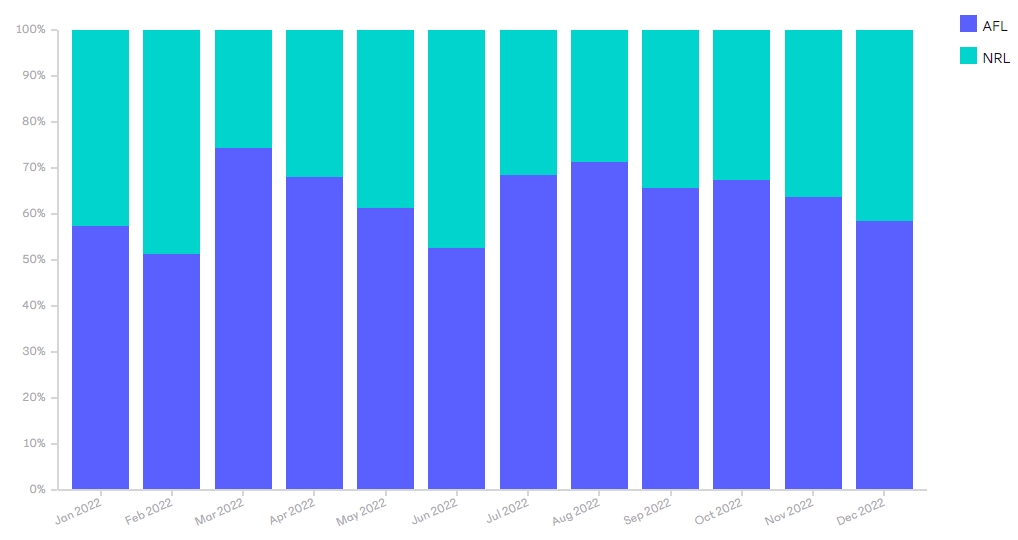

In the 2021 financial year, the AFL generated over $738m in revenue and the NRL $570m1. This is reflected in their budgets—AFL spent $5.2m on marketing and advertising compared to the NRL’s $2.8m.

Source: Bigdatr, Media Value, NRL & AFL. Start a free trial to get more insights.

Source: Bigdatr, Media Value, NRL & AFL. Start a free trial to get more insights.

Their spending pattern is similar, coinciding with the start and end of the season, which means they are competing for the same space at the same time. Or are they?

Spending across the States

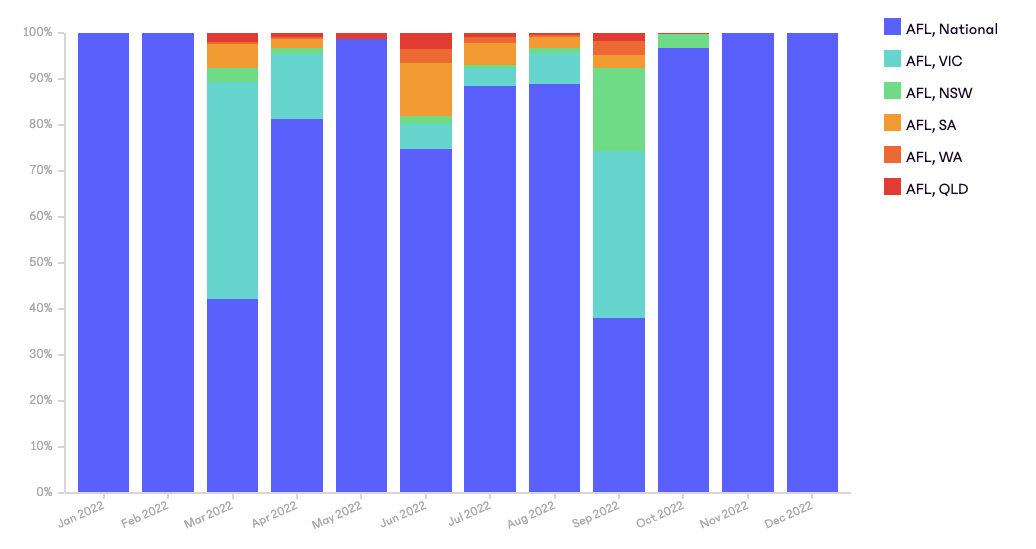

For both sports, national advertising spend takes precedence. But it’s evident that AFL is a two-state game. The biggest spend was in the state of Victoria - home to the bookie’s favourite and eventual winners.

Source: Bigdatr, Media Value, AFL, Split regional spend.

Source: Bigdatr, Media Value, AFL, Split regional spend.

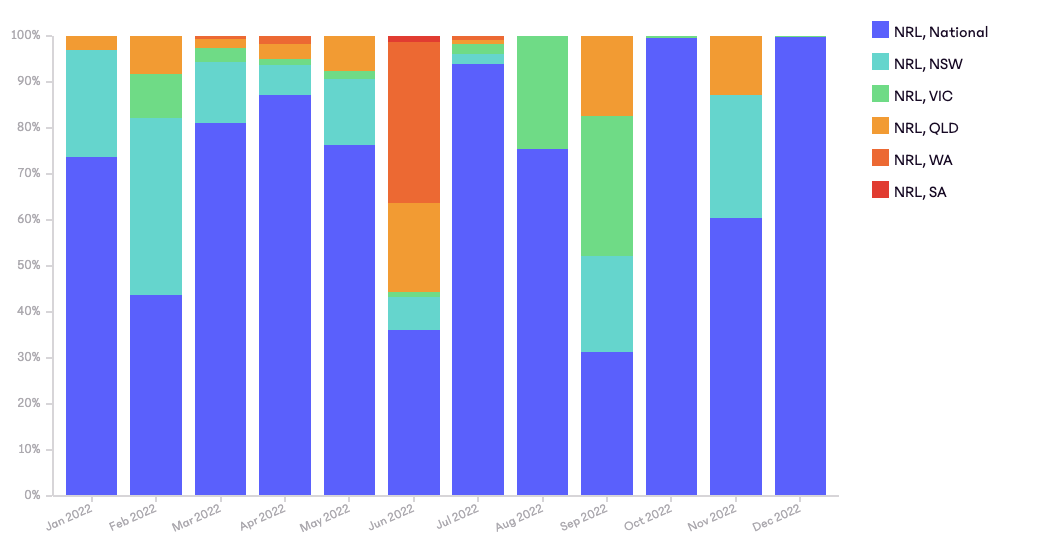

For the NRL, their spending followed the rollercoaster of the season itself. Peaking in Queensland during the State of Origin and then again as we edge closer to the end of the season. It stops entirely once the Cowboys get knocked out of the final five and ramps up nationally and in NSW as the all-Sydney final approaches.

Source: Bigdatr, Media Value, NRL, Split regional spend.

Source: Bigdatr, Media Value, NRL, Split regional spend.

Which channels made the cut?

When it came to allocating their budgets, Digital Display and Social Media were in the top three channels for both sports. However, the final spot was drastically different.

The NRL favoured free-to-air metro advertising, which took over 30% of their total spend. The AFL instead bet big on out-of-home, devoting more than 3x the budget compared to the NRL in this channel.

A return to the billboard

Advertisers are taking advantage of people returning to the office and shopping centres. Digital Out Of Home (DOOH) experienced a 21.5 percent year-on-year growth rate in 2021 and PWC predicts it will continue to grow faster than its physical counterpart2.

In 2022, the sports industry spent almost $15m on Out-Of-Home advertising. The AFL were the second biggest spender just behind the Australian Open and slightly above the A-Leagues.

While the NRL trailed behind the AFL in terms of overall spend in this category, they went all-out to publicise the State of Origin, spending the majority of their out-of-home budget during the month of June.

Capitalising on subscription TV

The NRL are big believers in TV. Despite low viewer numbers for the 2022 Grand Final, overall figures, including NRLW, rose by about 50% compared to 20203. And where can they capture more of those viewers? Subscription TV.

According to Deloitte’s Media Consumer Survey 2022, the average number of paid entertainment subscriptions per household is 3.1. The NRL looked to capitalise on this by allocating 7% of their budget to subscription TV compared to the AFL’s 0.4% spend.

How did they shape up creatively? Similar themes but different feels.

AFL: This Is Us

The AFL’s brand campaign that featured heavily across their digital channels was high energy and light with a family feel. The well-chosen soundtrack— Jump by Van Halen, was nicely paired with touches of humour—players oiling their arms pre-match or the security guard commentating to himself as Buddy Franklin lines up a goal kick.

Source: Bigdatr, Advertising Creative. March 2022 - Jun 2022

Source: Bigdatr, Advertising Creative. March 2022 - Jun 2022

NRL: Unreal

The NRL’s Unreal brand campaign used across all their channels was earthy and emotive. We thought the use of father and son team Ivan and Nathan Cleary being mirrored by a regular grassroots parent and child was a clever pull at the heartstrings.

Source: Bigdatr, Advertising Creative. March 2022 - May 2022

Source: Bigdatr, Advertising Creative. March 2022 - May 2022

It’s a woman’s world

The popularity of women’s sports has seen exponential growth. Recent research revealed seven-in-10 Aussies watch more of it now than they did before 2020. 66% of Australians have tuned in to watch women’s sport on TV, and 72% of men are tuning into women’s sports, making up two-thirds of all viewers across AFLW, NRLW and the WBBL4.

How are the AFLW and NRLW capitalising on this newly engaged audience with their creative?

Both released brand ads to build awareness in the lead-up to the start of the season.

The AFLW’s ad used the angle of “girls are doing anything.” Leaving the viewer feeling empowered, it felt lighter than the NRLW ad and cleverly addressed general social commentary about women’s sports by using the phrase “don’t compare me, join me.”

Source: Bigdatr, Advertising Creative. Jan 1 - Mar 26 2022

Source: Bigdatr, Advertising Creative. Jan 1 - Mar 26 2022

The NRLW’s creative used plenty of on-field action with an emphasis on playing hard, sacrifice and heart. We felt the powerful voiceover by 2018 Australian Poetry Slam Champion and Djapu writer Melanie Mununggurr delivered just the right amount of impact.

Source: Bigdatr, Advertising Creative. Jan 17 - Mar 5 2022

Source: Bigdatr, Advertising Creative. Jan 17 - Mar 5 2022

Up your game with richer competitor insights

Spend your marketing budget more wisely and make strategic decisions by registering for a free 7-day trial on Bigdatr’s platform. Easily find, see, track and share your competitors' advertising in real-time.

No credit card details are required.

*Media Value figures are an accurate estimate at the time of publication, 7 March 2023. Figures are subject to change as new data becomes available.

References

- Statista

- The Australian Entertainment & Media Outlook, 2022-2026, PWC

- http://www.footyindustry.com/?p=173628

- https://www.foxsports.com.au/women-in-sport/international-womens-day-2022-growth-of-womens-sport-market-research-by-fox-sports-tv-audiences-participation/news-story/dbda91408a07a9f235f1dcf1bd4025a5